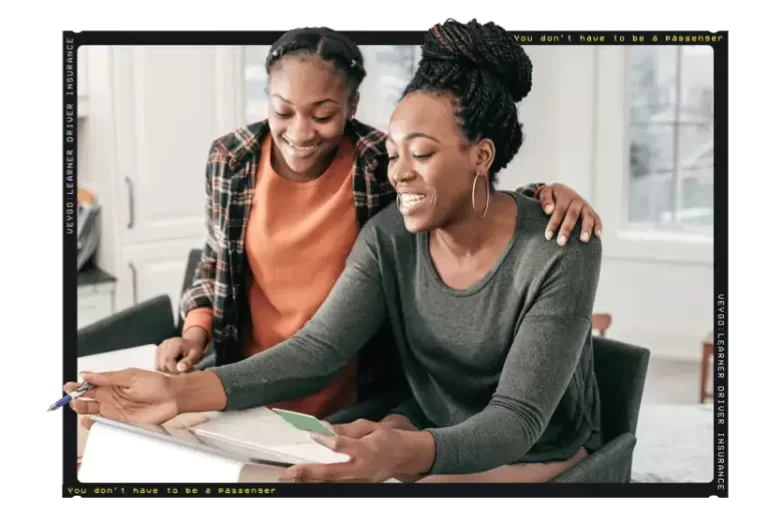

Young driver insurance

Cheap car insurance for first time drivers

If you’re a parent of a young person or a young driver looking for insurance, Veygo will help you find car insurance at the right price.

![]() Choose the right insurance for you - learner, temporary, or black box insurance

Choose the right insurance for you - learner, temporary, or black box insurance

![]() Be on the road in minutes

Be on the road in minutes

![]() Part of the Admiral Group - a name you can trust!

Part of the Admiral Group - a name you can trust!

We are part of the Admiral Group

Cheap and trusted insurance for young drivers

At Veygo, we want to help young drivers to get insured on the road quickly and without breaking the bank.

It’s no secret that insurance policies for young drivers are extortionately high. At Veygo we want to help support new drivers to get insured quickly and as cheaply as possible.

As part of the Admiral Group, we are part of a brand and name you can trust.

What insurance do Veygo offer a young driver?

We have two main options at Veygo which should help cover new drivers:

Temporary car insurance

A perfect way to get cheap insurance as a first-time driver if you aren’t after longer-term insurance. Temporary car insurance means you can get insured as and when you need it. We can cover you from one hour up to 60 days.

![]() Be on the road in minutes

Be on the road in minutes

![]() 1 hour to 60 days

1 hour to 60 days

![]() No impact on the owners no claim bonus!

No impact on the owners no claim bonus!

Learner driver insurance

If you haven’t passed your test yet but need insurance, then our learner driver insurance can cover you from one hour to 180 days. It’s a great way to get extra practice or learn in another car.

![]() Be on the road in minutes

Be on the road in minutes

![]() 1 hour to 180 days

1 hour to 180 days

![]() No impact on the owners no claim bonus!

No impact on the owners no claim bonus!

Veygo insurance benefits:

![]() Affordable premiums

Affordable premiums

![]() Same-day coverage

Same-day coverage

![]() Trusted provider (rated Excellent on TrustPilot)

Trusted provider (rated Excellent on TrustPilot)

![]() Cover from one hour to 180 days

Cover from one hour to 180 days

![]() Insure your own car or someone else’s

Insure your own car or someone else’s

![]() Flexible policies – single duration, monthly or a personalised period

Flexible policies – single duration, monthly or a personalised period

If you are looking for something longer term, we also offer:

Black Box – Veygo are part of the renowned Admiral Group, so if you are looking for a Black Box policy, then Admiral’s LittleBox will be just what you’re looking for.

How do I get Veygo insurance?

Getting a quote through Veygo is simple – we only need a few details, including your age, whether you hold a full or provisional driving licence and details about the car you’re looking to insure.

![]() Your Age

Your Age

![]() What licence you hold

What licence you hold

![]() What car you are looking to insure

What car you are looking to insure

Am I eligible for Veygo’s young drivers’ insurance?

As a new driver, you’re eager to get insured and get out on the road. However, we want to make sure we can cover you first. See below if you are eligible for our insurance policies:

| Temporary Insurance | Learner Insurance | |

|---|---|---|

| You must be between 17 and 75 years old. | | |

| If you’re aged between 17 and 21, and it’s for your own car, you need at least 6 months on your license. | | N/A |

| You should have a valid UK provisional license. | | |

| You should not have any penalty points. | | |

| You should have no more than 9 penalty points. | | |

| You must not have been disqualified in the last 18 months. | | |

| You need the car owner’s permission. | | |

How much does car insurance cost for a young driver?

£419 per year

According to UK statistics, the average cost of a car insurance policy is around £419 per year. Unfortunately, for inexperienced or new drivers, this price is often significantly higher.

£830 per year

For younger and more inexperienced road users, an average policy can cost around £830 with some insurers – almost double the UK average. If younger drivers choose not to take advantage of any additional money-saving and safety options – like black box policies – the cost of premiums can enter the thousands. Veygo want to help young drivers get on the road for less, which is where our temporary insurance policies can help keep down the costs that longer term solutions bring.

Find out how much we can save you!

Find out how we can save you money on your car insurance policy and get you on the road for less by contacting us today or by getting a quote.

Why is car insurance for young drivers so expensive?

Because car insurance policies are calculated on risk, young and inexperienced drivers face the highest premiums.

One in five drivers are involved in a crash in their first year of driving – regardless of age – while young male drivers aged 17 to 24 are four times more likely to crash and be injured on the road than those aged 25 and over.

Younger drivers are drastically overrepresented in accident statistics despite making up a relatively small percentage of road users. This is often due to age and inexperience.

While not all young road users drive recklessly, these statistics are considered by insurance underwriters when drafting policies. Unfortunately, this results in higher premiums for all young drivers.

How can young drivers lower car insurance premiums?

It’s no secret that young and inexperienced drivers have the highest insurance premiums. As a first time driver, that can be a daunting prospect.

However, there are things that you can do as a new driver to keep your premiums down.

For example:

Choose cheaper cars to insure – Compact vehicles with smaller engines are less expensive to cover than bigger cars with more powerful engines.

Avoid modifications – Not only do mechanical modifications increase the value of the car – meaning increased insurance costs – but those that improve performance can increase the likelihood of an accident.

Many insurance providers void policies if illegal or undocumented modifications are found on the vehicle after a crash. Any modifications must be declared. However, remember that modified cars are more expensive to insure.

Avoid modifications – Not only do mechanical modifications increase the value of the car – meaning increased insurance costs – but those that improve performance can increase the likelihood of an accident.

Many insurance providers void policies if illegal or undocumented modifications are found on the vehicle after a crash. Any modifications must be declared. However, remember that modified cars are more expensive to insure.

Consider additional qualifications – Courses offered after passing your test – like the Pass Plus scheme – reduce your premiums because you’re viewed as more experienced and qualified, and less of a risk to insurers.

Why choose Veygo?

Veygo understands the needs of aspiring young drivers looking to enjoy the freedom that comes with driving without the unaffordable price tag.

Our temporary car insurance policies provide comprehensive cover that protects you, your vehicle and other road users – letting you practice with confidence.

Why choose Veygo?

Young driver FAQ's

- opener

What type of insurance is best for young drivers ?

Not all young drivers are dangerous drivers. But limited experience means they are statistically more likely to get into an accident in their early years of driving.

New drivers are encouraged to take out a comprehensive insurance policy that covers them and other road users against accident costs should the worst happen.

The best policy types in our opinion are:

Telematic insurance – otherwise known as ‘Black Box’ policies, these are small devices fitted to cars that measure a driver’s acceleration, speed and braking to gauge how safe or dangerous their driving is. Motorists that meet the conditions outlined in the insurance policy are rewarded with cheaper premiums.

Some specific black boxes may monitor G-forces, smoothness of driving, cornering speed, time of day and impact force in the event of a crash.Temporary car insurance – this allows you the freedom to purchase insurance for when you need it. For instance, if you wanted to borrow your parents’ car you can do so without risking their No Claims Bonus, if you were added to their existing policy as a named driver. It may also work out cheaper than purchasing a longer term insurance, depending on your needs.

Learner driver insurance – if you’re learning to drive, purchasing learner driver insurance is a great way to get extra practice in another car. We can cover you from 1 hour to 180 days, depending on how long you need. - opener

Can a parent add a young driver to their insurance ?

No, not through Veygo.

However, that may not be a bad thing! Parents should be wary, as adding a young driver is likely to raise the cost of the policy.

If you’re a parent looking to put a young driver on your car insurance policy, it’s important to read the fine print. If the young driver has an accident, it can affect your no-claims bonus too. Veygo offers a temporary car insurance policy that is separate from the main policy. - opener

What are the best cars for young drivers to get cheaper insurance ?

As a young driver, the safer the vehicle is deemed, the cheaper the insurance policy.

Every car is assigned an insurance group based on its characteristics to make it easier to calculate the price of a premium.

For example, purchase price, repair costs, availability of parts, safety and engine power all play a role in determining a vehicle’s group. There are 50 groups in total.

Cars that are more compact, inexpensive to purchase and run, and have smaller engines are typically found in the lower groups, while high-end sports and luxury models are often found in the higher groups.

Some of the best models for young drivers in the cheapest two insurance groups include:

Ford Fiesta

Volkswagen Polo

Hyundai i10

Kia Picanto

Vauxhall Corsa

Skoda Fabia

Fiat 500

Volkswagen UP!

Dacia Sandero

Renault Clio

It’s important to note that engine size, vehicle age and any sports or performance upgrades may also factor into changing prices. - opener

Do new cars help with cheaper insurance ?

New cars are not necessarily cheaper to insure, with the cost of modern vehicles often raising policy premiums due to the risk to the insurer.

Although newer cars have improved safety features that can lower premiums, these savings are offset by the increased cost of insuring newer vehicles with a higher price tag. - opener

What are the lowest insurance groups cars for young drivers ?

The lowest insurance group for young drivers is band one.

Insurance bands range from one to 50 – with the lower the insurance band number, the cheaper the car is to insure. Lower groups represent compact cars – like town cars or smaller hatchbacks – while those placed into the highest bands are often expensive performance or luxury vehicles. - opener

What insurance do I need while learning to drive ?

If you’re learning to drive with a licenced instructor or through a driving school, their ‘any driver’ policies already protect you – so you don’t need to worry.

If you’re learning with a parent, unless they have a similar package, you’ll need insurance to cover you when practicing.

Before getting behind the wheel, you’ll need to make sure you have a form of temporary car insurance or provisional insurance. At Veygo, we offer learner driver insurance, so, why not get a quote today and get practicing. - opener

What insurance should I get now I've passed my test ?

There are three main insurance options to cover you and your car once you’ve passed your test.

These are:

Third-party – The minimum insurance coverage required by UK law. It only covers costs related to injuries and property damage sustained by non-fault parties in incidents where the policy holder was deemed to be at partially at fault.Third-party, fire, and theft – The minimum insurance coverage required by UK law. It only covers costs related to injuries and property damage sustained by non-fault parties in incidents where the policy holder was deemed to be at partially at fault., additionally the policy holder's vehicle is covered in the event of a fire or theft.

Comprehensive – This is the highest level of coverage available that safeguards against:

- Vehicles damaged or destroyed in an accident, regardless of liability. It also cover third-party costs relating to incidents where the policy holder is at least partially liable.

- Your vehicle being stolen or suffering fire damage (similar to third party, fire and theft coverage)

- Theft of the contents of the vehicle. (up to £150)Ultimately, it’s up to you which cover you think you need.

Third-party, fire and theft protection can be a cost-effective option if high insurance costs aren’t worth it for the vehicle value.

However, comprehensive insurance coverage provides complete peace of mind. In the event of an accident, these insurance policies make sure you don’t face substantial repair bills or risk having to replace your car or any of its content.

Comprehensive insurance allows for optional extras like recovery services, courtesy cars and breakdown cover – which is also recommended for those new to driving and needing extra assistance at the roadside.